(can very well be read to the beautiful tones of "Femme Fatale" by Nico)

They indicate that the situation is much more dire and serious than what we are led to believe by the statistics, which are deceitful, to say the least (this is especially touted by oil geologist Art Berman). Among other things because we do not know how much of the crude+condensate that is condensate and how much is only crude oil. Still we don't know that, for the most part of the oil industry, as far as I know. We have no graphs on this. "They" want the gap between these two factors, the crude and the condensate, to be small, of course, but it grows all the time, and probably at an accelerated pace.

In

this recent blogpost on the blog

Peak Oil Barrel by Dennis Coyne, we learn three important things:

1) That global oil production, All Liquids, had a new all-time peak, which happened, according to Steve St. Angelo (quoting EIA in

this blogpost on the

SrsRocco Report blog), in September 2023, and according to Dennis Coyne's graphs, probably in December 2023 at 102.4 million barrels per day (mbd). This was a very sad and horrible fact, and was not expected by me.

2) That global oil production (All Liquids) has fallen since this Coyne peak in December 2023 with a whopping 600 000 mbd in one month. This is the last data. This is a rapid decline. If this decline pace would continue, this would mean a 7,2 mbd decline just in one year. This is the decline pace that the world probably will see at some time in the distant future, maybe during the next decade, if global heating does not annihilate us or if the Second Coming of Jesus does not take place yet.

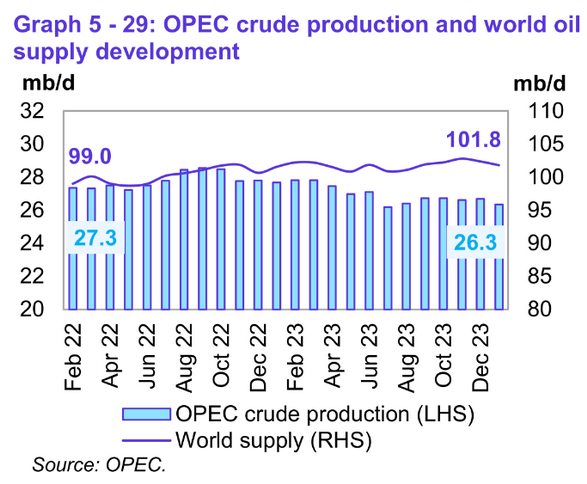

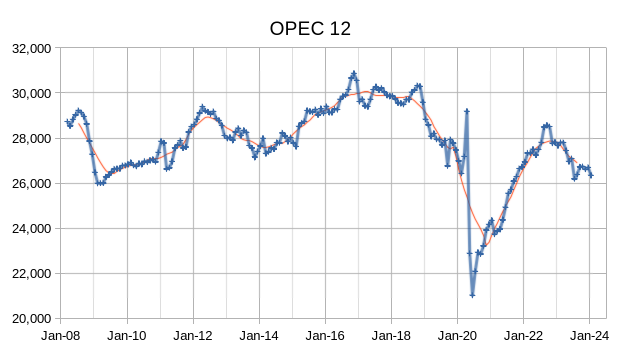

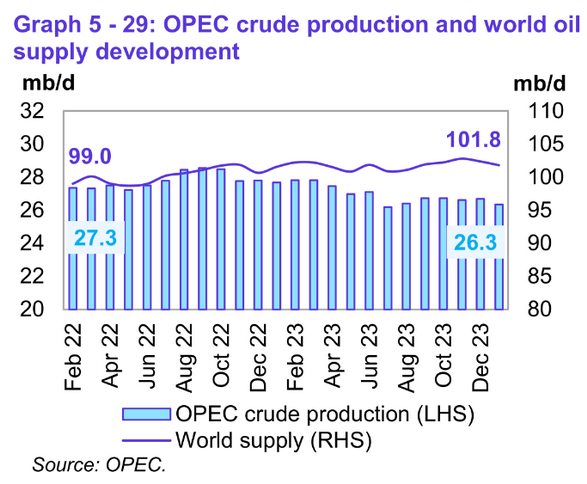

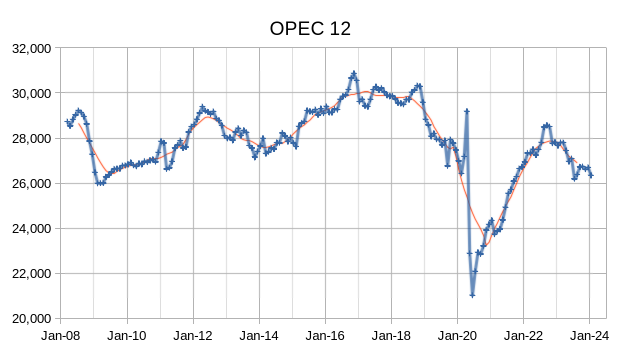

3) That the oil production which really counts, that of OPEC (which

contains 79,5 % of all oil reserves, OBS!

both conventional and unconventional oil reserves), continues to fall off a cliff, after its post-pandemic peak of August-September 2022. See this recent graph by Coyne:

My comments: Since non-OPEC oil production is often very much else than conventional crude oil, and becomes increasingly expensive, especially in the shale sector, we should actually care most about what happens in the OPEC oil production countries, which are the countries with solid basis for their oil production. Non-OPEC oil production is not at all sustainable, and is in a bubble modus, driven by America and Canada, two gigantic bubble economies.

If we take OPEC+, and add Russia to the mix, Russia alone has 6 % of global oil reserves, and is also in decline. This takes us to 85,5 % of the global oil reserves, both conventional and unconventional. This actually means that most of the oil world is in decline.

America has not much of oil reserves, only 2,1 % of them as of 2016 data. America is the leading non-OPEC oil producer.

America has MONEY, and thinks it can save its economy by increasingly expensive unconventional shale oil, which was very expensive from the very beginning, not the low hanging fruit it has been marketed as. It is in fact horribly expensive. We cannot count on it. We cannot build our future dreams on it. We just can't.

The same can be said about Canada, the other leading non-OPEC oil production country. Horribly expensive oil production, mostly oil sands, bitumen.

Some comments about global net oil exports

I still stand, to some degree, behind my calculations in

my book about global oil exports, but I think the absolute upper limit for the end of global net oil exports, counting "All Liquids", may be in the next decade, sometimes between 2030 and 2040. It cannot, I think, surpass the year when we lose our conventional oil reserves, which is, according to

Charles A.S.Hall, in 2047 (in a

2022 study, and I think he counted only conventional reserves, but I'm not sure) and in 2048 according to my calculations,

here, where I only counted conventional reserves. The end of global oil exports has to happen

way before that.

If Jeffrey J. Brown was correct in his comments below the article I linked to in the beginning of this blogpost, then I think he did not count

crude+condensate in his estimates of global oil exports, but only crude. This makes sense. If we count the diesel ("the motor of civilization", or the very center of all transportation, what makes trucks and

ships - which uses "bunker diesel" - move), then it is crude oil, without adding condensate ("

refineries get very little diesel fuel from condensate", oil and gas expert David Moe says in

this comment), that really matters. To then think that peak crude exports minus condensate, peaked in 2005, at 45-46 mbd, as I and Brown has said, is fully reasonable. I think the crude minus condensate part of the oil production has declined since, and the crude only exports (without counting condensate) has declined even more so, in an

accelerated rate of decline.

For crude minus condensate, the end of exports may in fact happen around 2030, plus and minus a few years, just as Brown calculated in 2012-2013. And when the oil export industry collapses, the whole house of cards comes tumbling down, which makes civilisation collapse, making the oil industry impossible sooner than what we expected.