(This blogpost can very well be read to the sound of the melancholic hip-hop song "Ibbe Q Feat. Nadia K - Kom Hem", which was made to the memory of a hip-hop martyr)

"

The Permian shale oil basin" is where the last growth of the global oil industry has mostly taken place over the last years. It's a gigant, bigger than Ghawar in Saudi Arabia, which was before the greatest oil field in the world. Now it's the Permian's turn to have that title.

Is the Permian basin beginning to peak? Firstly, check out the following nine fateful articles from 2023 and 2024 + one recent Youtubevideo. There has been written and said a lot about it recently, but also in 2022, 2021 and 2020:

-Natural resource investors Goehring and Rozencwajg wrote in May 2023 this blogpost on their blog that the Permian basin was depleting faster than generally believed and that output might peak already in 2023.

From the article: "Natural Resources analyst firm, Goerhring & Rosenscwajg-G&R, has modeled production trends that suggest that "Hubbert's Peak" for the Permian will hit late next year. Hubbert was a geologist who theorized that once half a basin's reserves had been recovered, it would have essentially “peaked.” The graph below, taken from a G&R report highlights their expectations. G&R could be of some, but the point remains, there is an inflection point coming that will tilt the slope downward. The firm estimates using their models that about 20 bn barrels of commercially recoverable oil remain in the basin. At current production rates, that’s about 11 years of output."

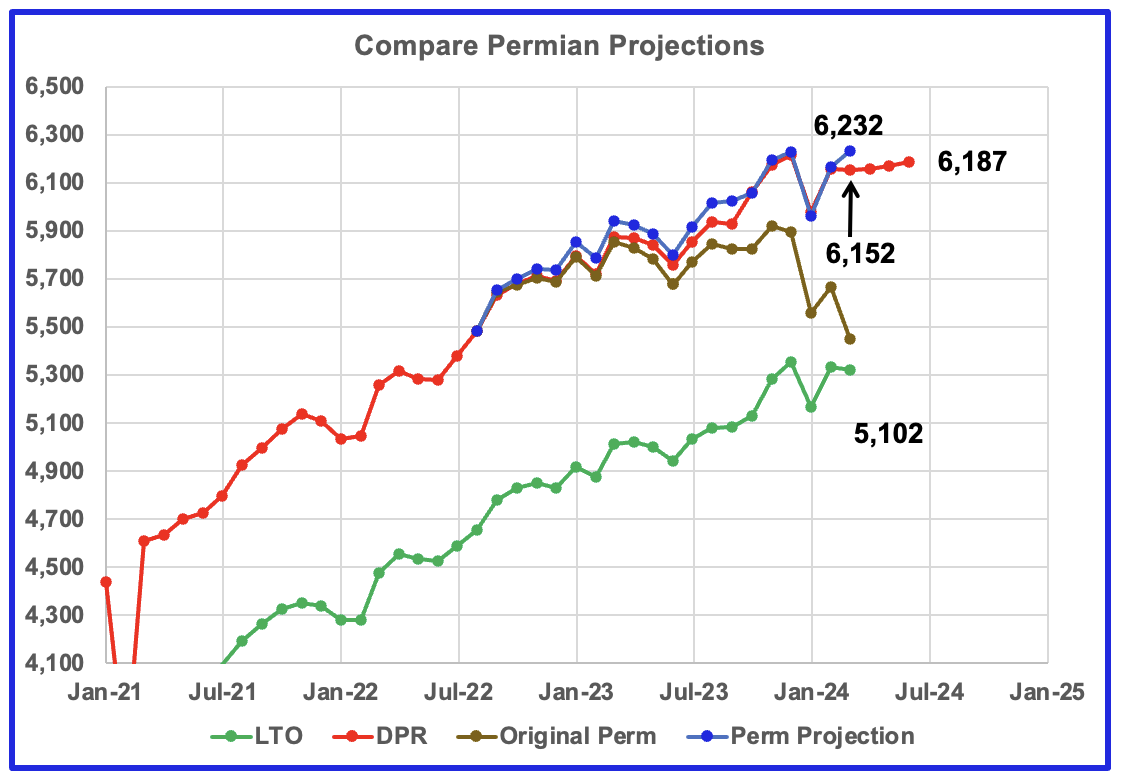

Study then the following four fateful charts from this recent blogpost by Ovi on the blog Peak Oil Barrel:

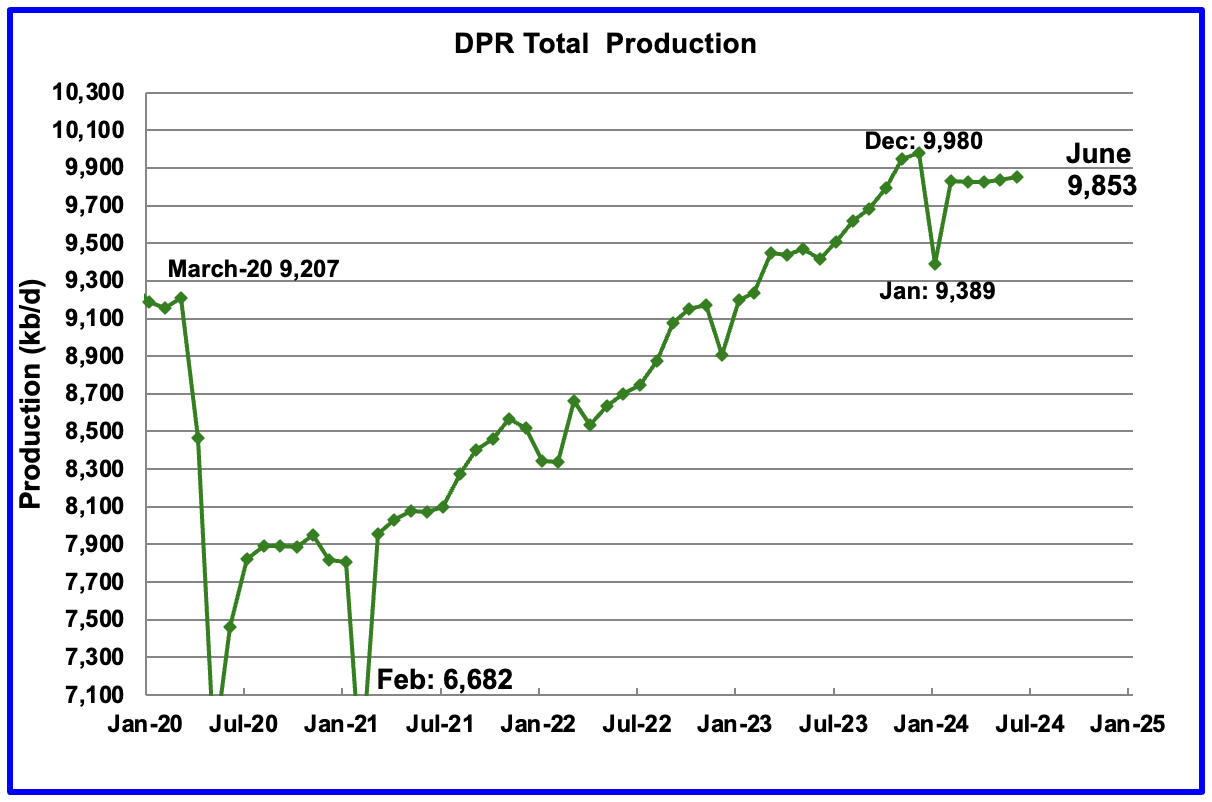

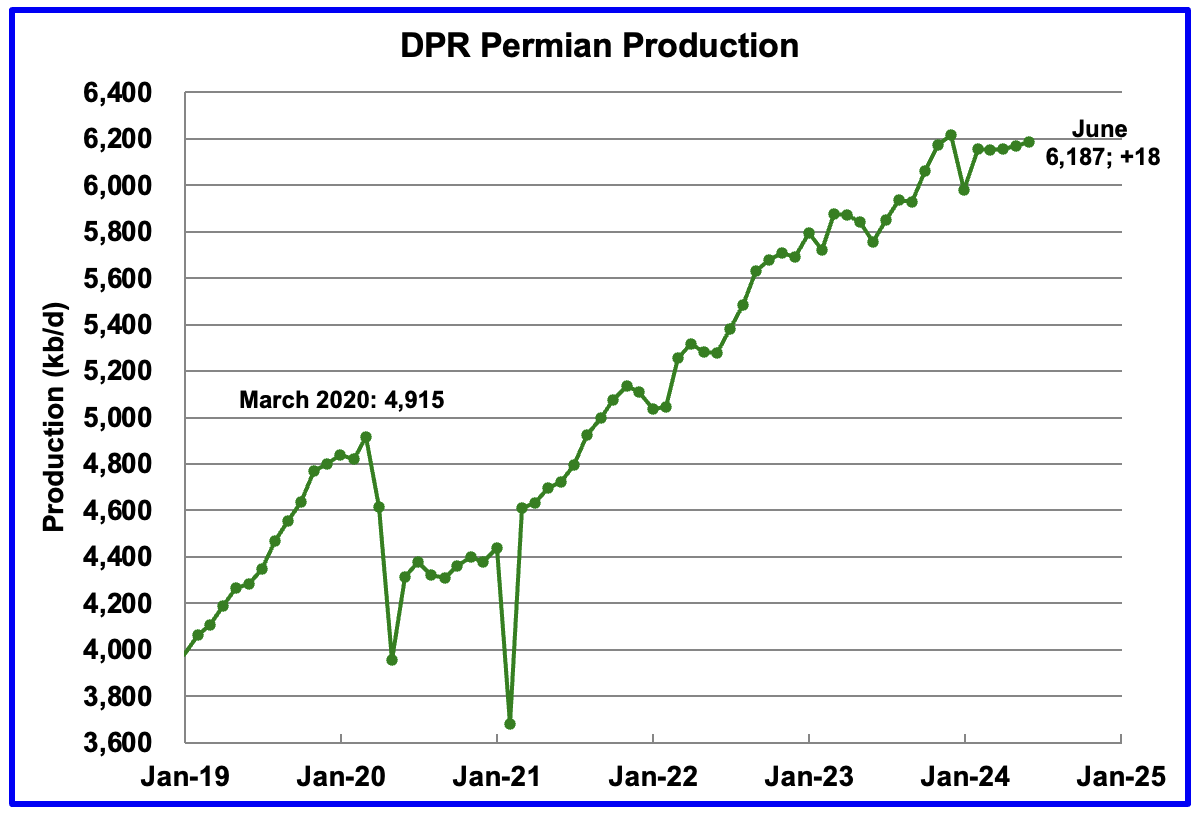

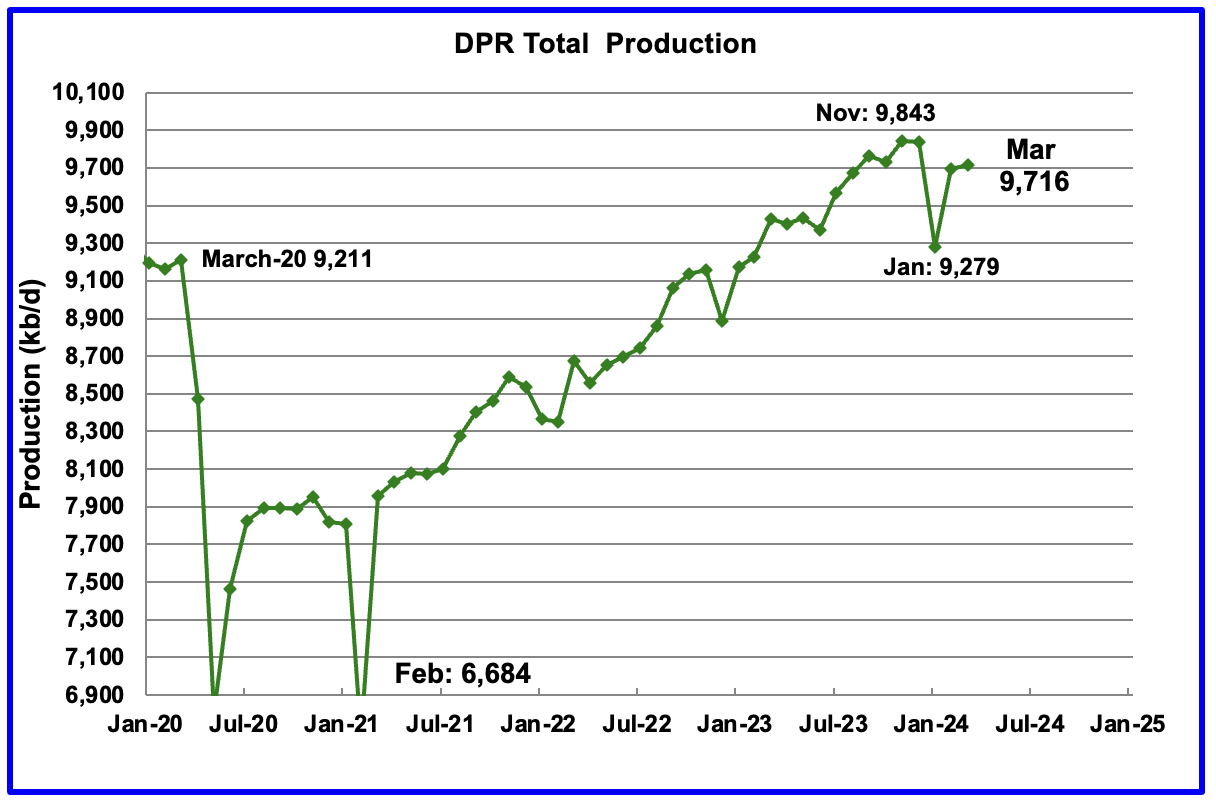

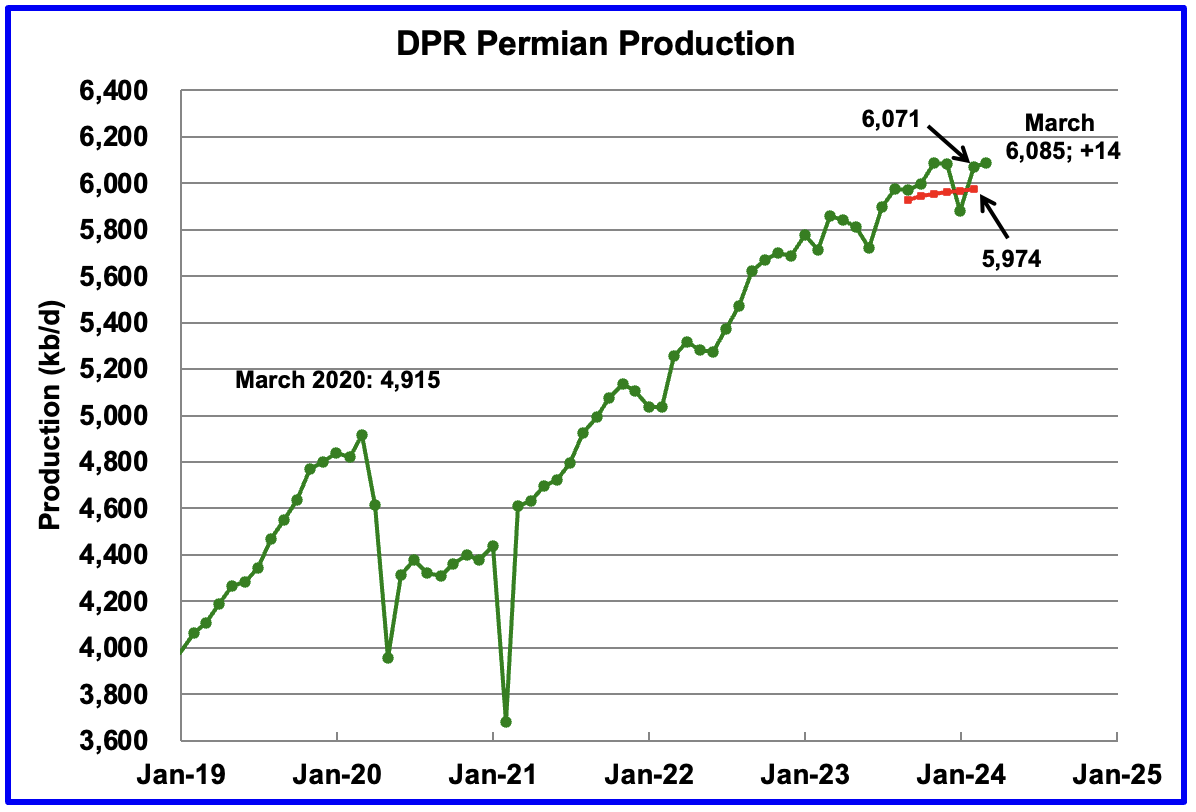

(DPR means Drilling Productivity Report. The "total" means all shale oil plays in the US)

An update 20.6.2024:

Signs abound that the US shale oil sector has indeed peaked already. "

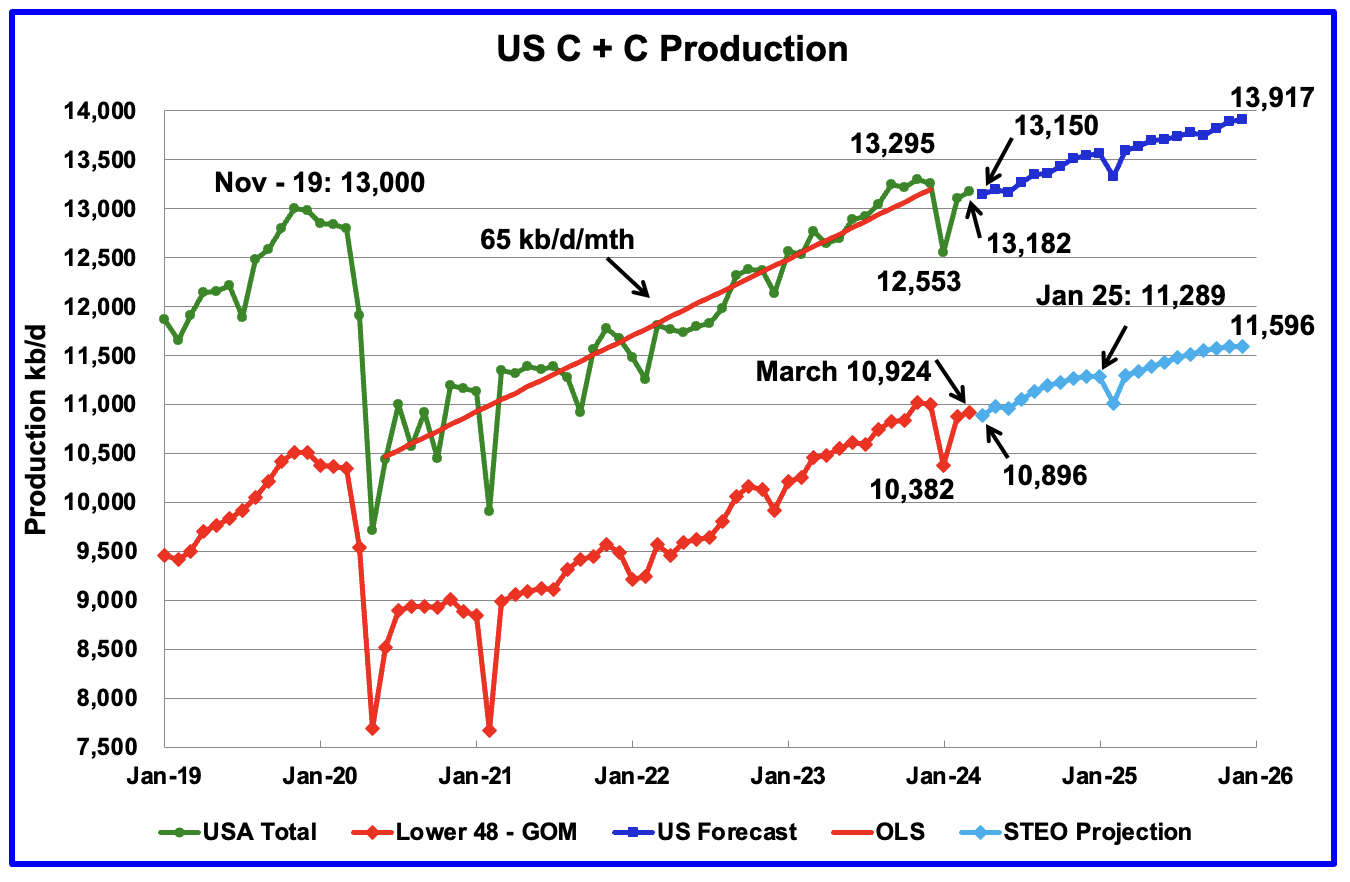

US oil production has been flat since September 2023", says peakoiler OVI in the beginning of

this blogpost on the blog

Peak Oil Barrel, from 5.6.2024.

For more confirmation, follow the blog

Peak Oil Barrel and the extremely important work they do there, to track the oil industry in the US and globally. From

this blogpost on this blog, are the following graphs from US oil industry and it's shale sector, that speak more than thick volumes on the subject:

Update 17.7.2024: In

this comment to

this blogpost on

Peak Oil Barrel there is an update to the chart above, from July 12, 2024, where we see that the

Frac Spreads has declined precipitously, by 12:

From

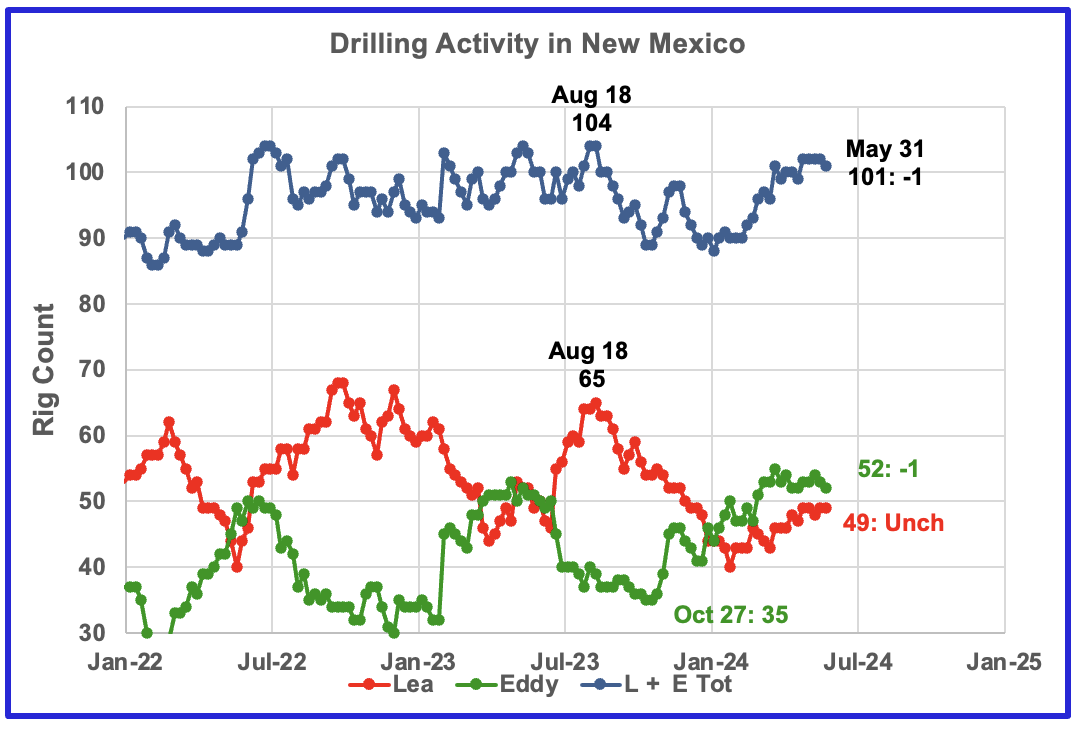

this blogpost on the same blog, from 5.6.2024, see these following charts:

My own comment to the chart below: The Permian shale oil play in New Mexico is the most important and biggest shale play in the world. See how drilling activity has plateaued since july 2022, which will have a big impact downstreams:

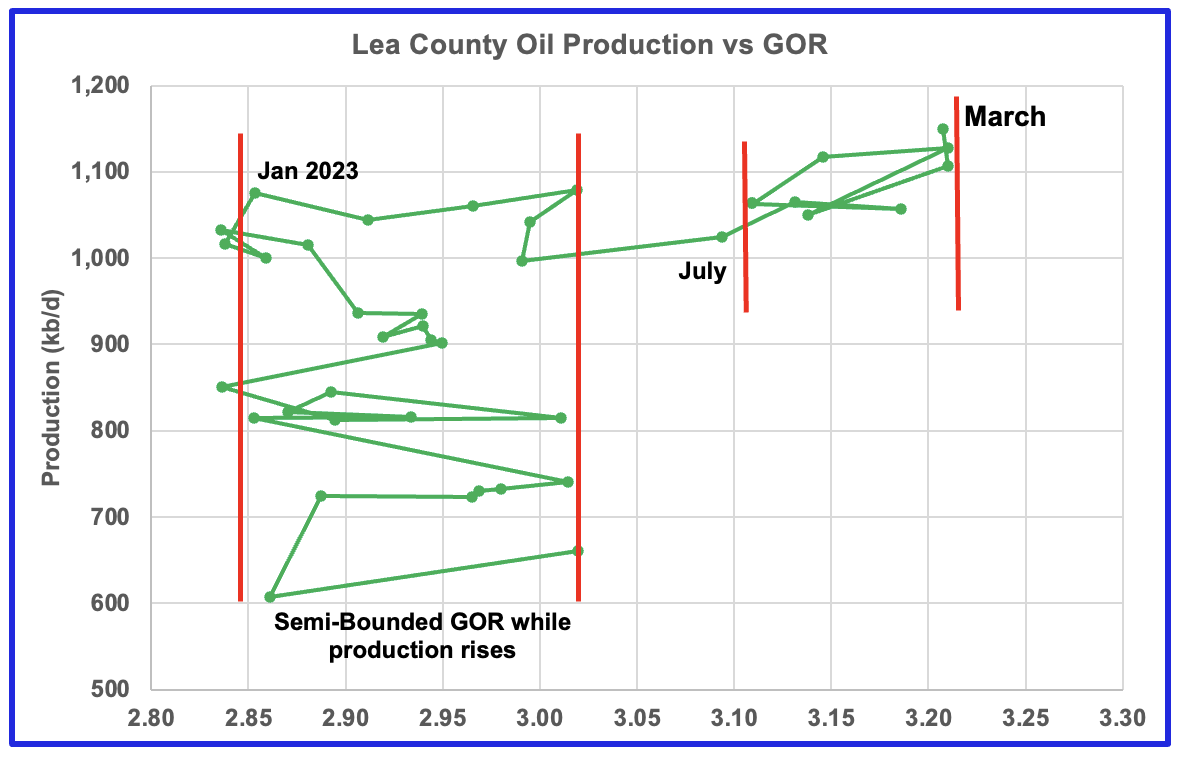

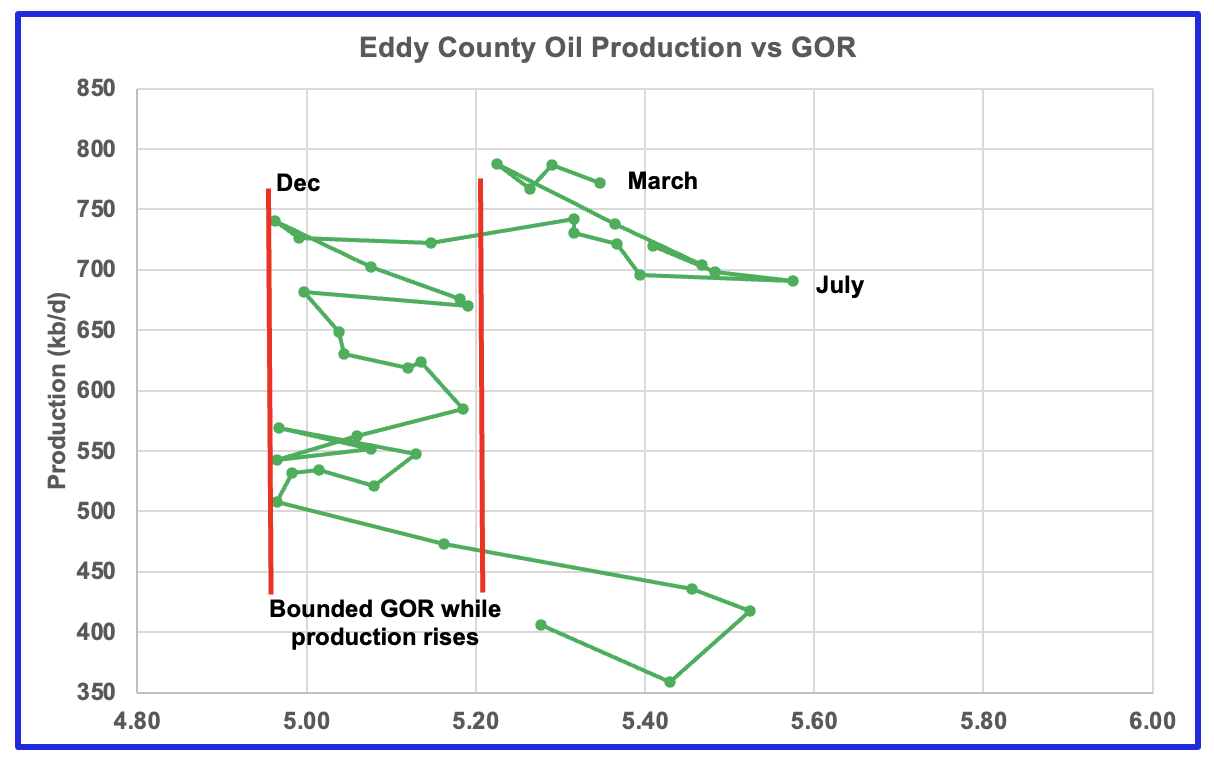

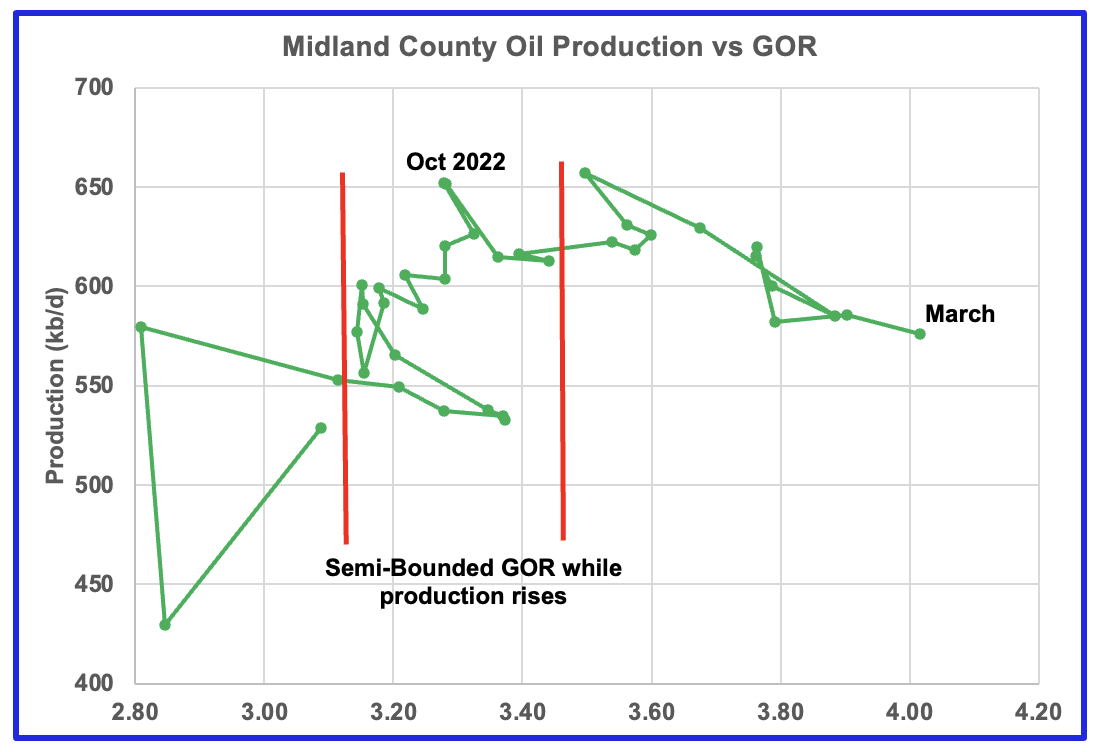

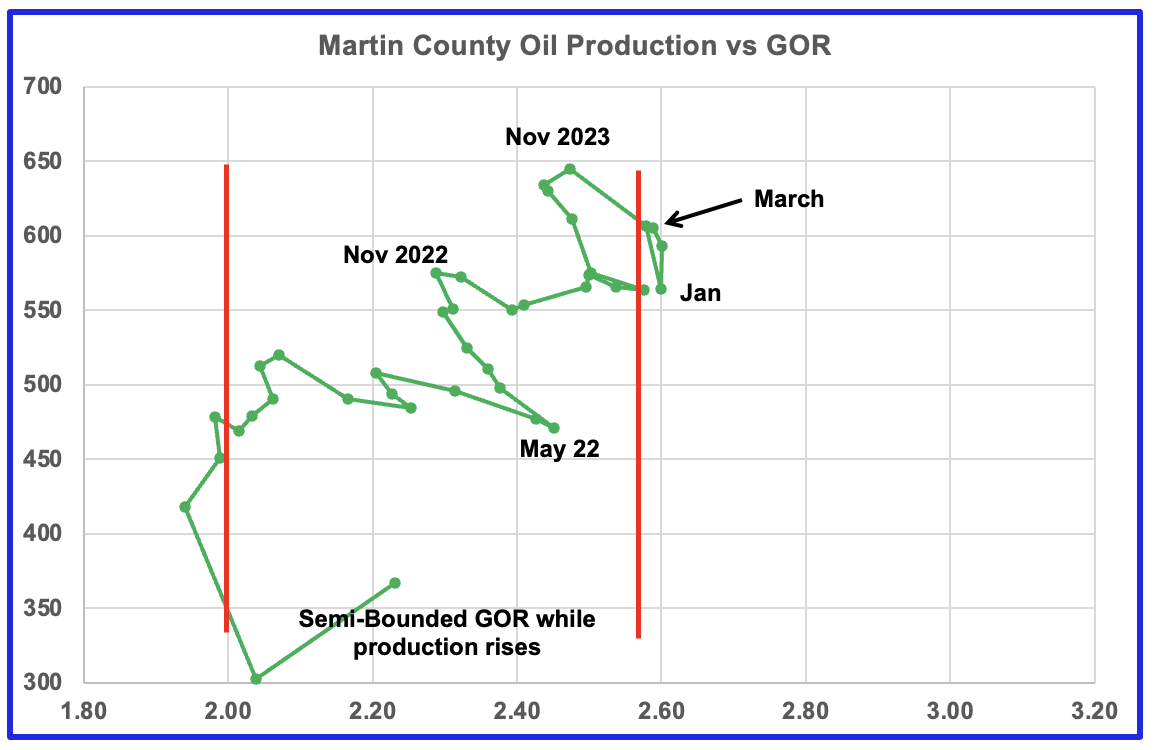

The pivotal signs of a peak in US shale oil are in these charts below of the most important shale countys, the Lea, Eddy, Midland and Martin countys (that the green line moves outside of the area between the red lines to the left, is the very sign that the county is peaking):

Addition 4.7.2024: According to

this blogpost today on the blog Peak Oil Barrel, all the four counties above are said to have peaked. This means that for all practical purpose,

the Permian has peaked. And this is according to official, corporate and government data, which often lies, which often is too optimistic.

From the same blogpost above my addition 4.7.:

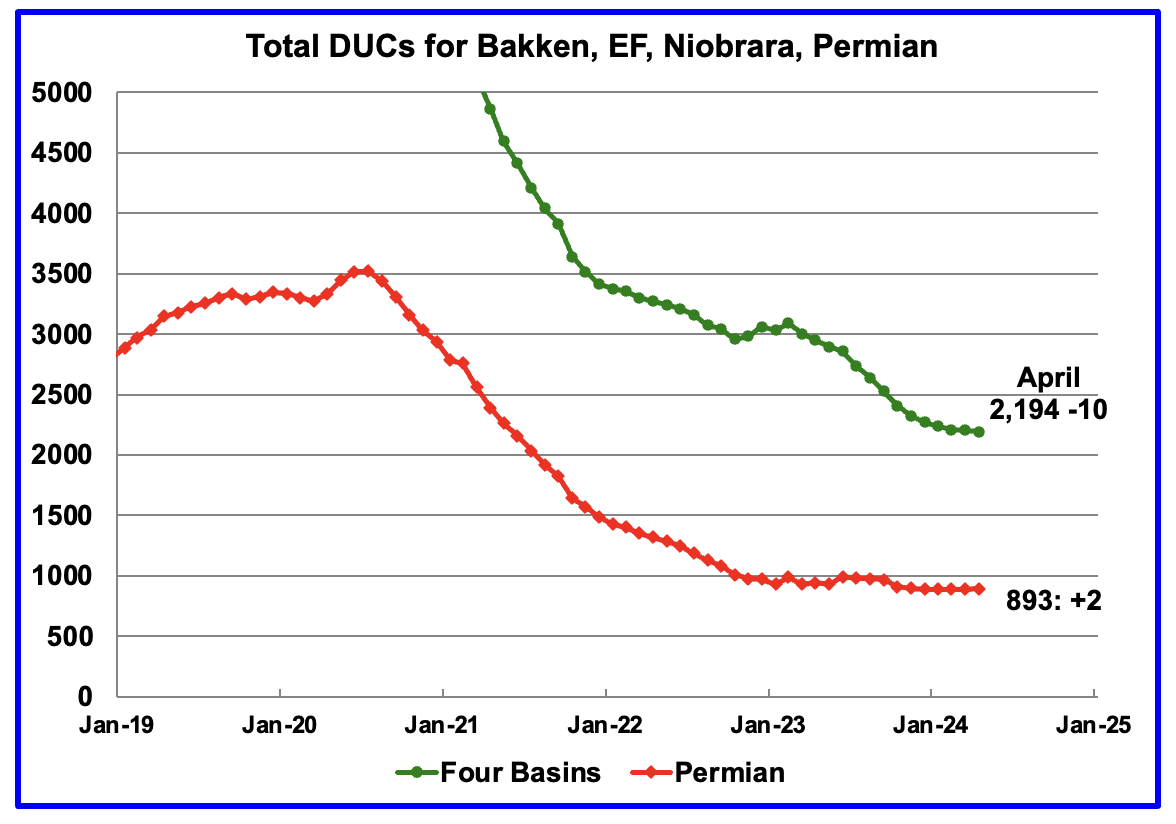

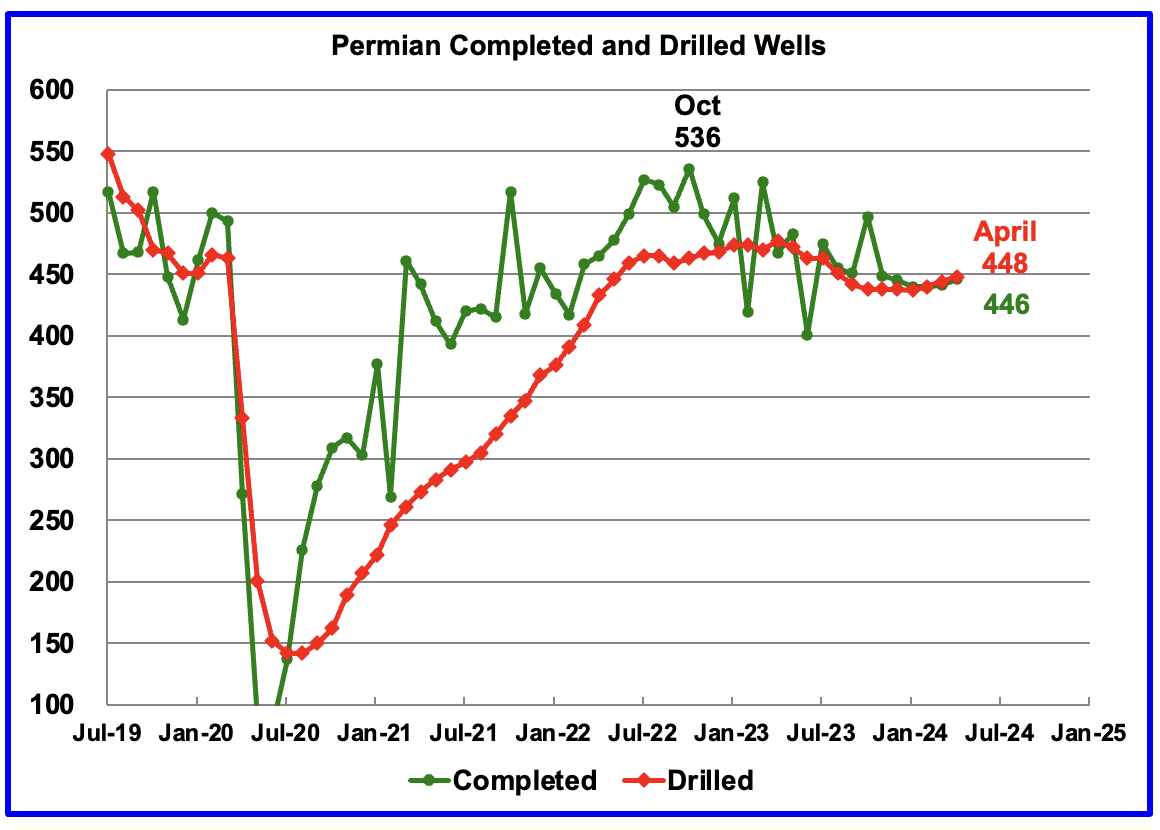

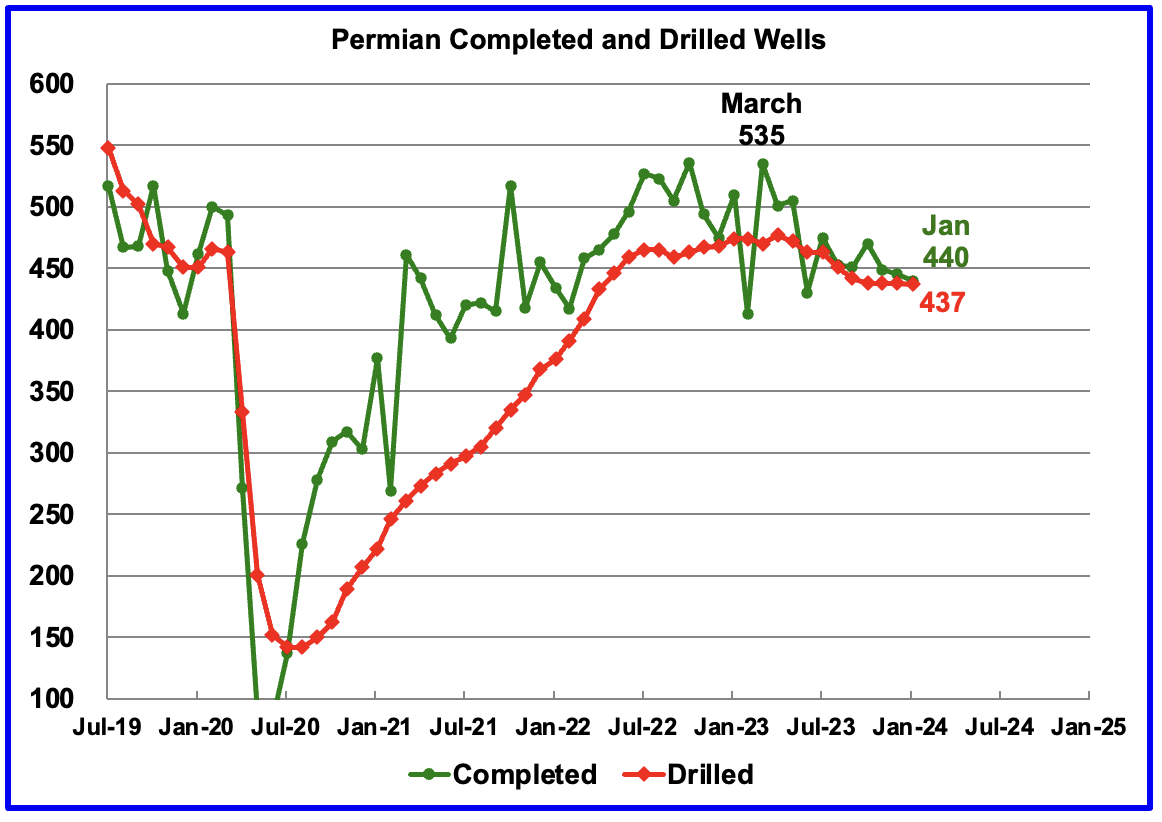

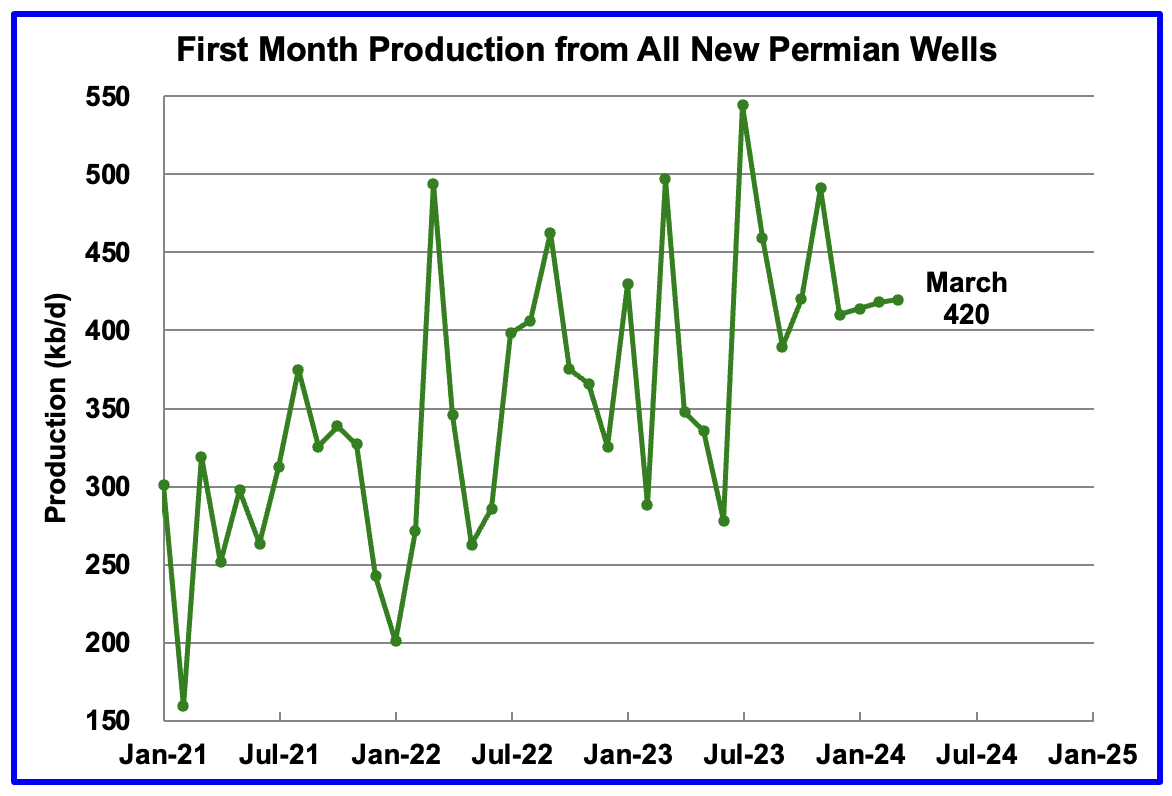

"The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The May DPR report forecasts production to June 2024 and the following charts are updated to June 2024. The DUC charts and Drilled Wells charts are updated to April 2024."

DUC means "Drilled but uncompleted wells" (my own comment to the chart below):

End of the quotes from the Peak Oil Barrel blogposts.

* * *

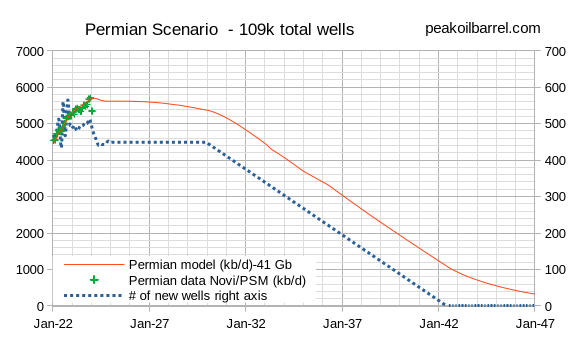

This chart by Dennis Coyne is from

this commen by him in the comment section below the last blogpost above:

End quote.

So according to this last chart, the Permian has indeed reached its all time peak. This is incredible, unfathomable news. It should be first page news in all newspapers of the world, but no newspaper report on it, for understandable reasons, it is not in line with the spirit of civilization/Babylon, which want eternal growth on a finite planet.

Update 17.7.2024: These data that I provided, are the official, corporate and government data, but mind that Chris Martenson has said that he is not sure he can believe in them. So distorted the numbers have been on all fronts in the economy, not least in the US. Think always about this when you look at graphs about oil and energy at large.

* * *

From the article from Jun 17, 2024:

"Based on the most recent OPEC+ guidance, total global oil supply growth will be near zero in 2024, which could render this year the first since 2020 with zero supply growth, Rystad said, estimating expect supply growth at around 80,000 barrels per day for 2024, down from earlier expectations of 900,000 bpd, which had been made in early June Reuters reported on Monday.

Rystad noted that OPEC+ cuts will take 830,000 bpd off the market in 2024 and 1.04 million bpd off the market next year, with U.S. shale being the most “trustworthy source” of supply growth.

“The market initially responded negatively to the latest OPEC+ guidance. However, it’s difficult to remain completely bearish when global oil supply growth is expected to slow down in 2024 and reduced production is still a possibility in 2025,” Reuters quoted Rystad vice-president Patricio Valdivieso as saying.

OPEC’s current strategy aims to keep production at a level that can support oil prices in a range of $80-$100/bbl, which becomes challenging if U.S. production continues to grow, as it has for over a decade and a half.

Last week, OPEC released its monthly oil market report (MOMR), keeping its demand growth forecast for the year unchanged at over 2 million bpd. Simultaneously, the International Energy Agency (IEA) released a new market report with significantly different projections, forecasting a “staggering” supply overhang of 8 million bpd in spare production capacity by 2030. The forecast angered OPEC, which called the prediction “dangerous” and warned it could inject additional volatility into oil markets." By Michael Kern for Oilprice.com

End quote.

I also want to share an incredible graph about the interest payments of the US, stemming from the decline of its oil industry (I found it in this blogpost, "The End Of Empire Rapidly Approaches", on the "Peak Prosperity" blog, by Chris Martenson):