* * *

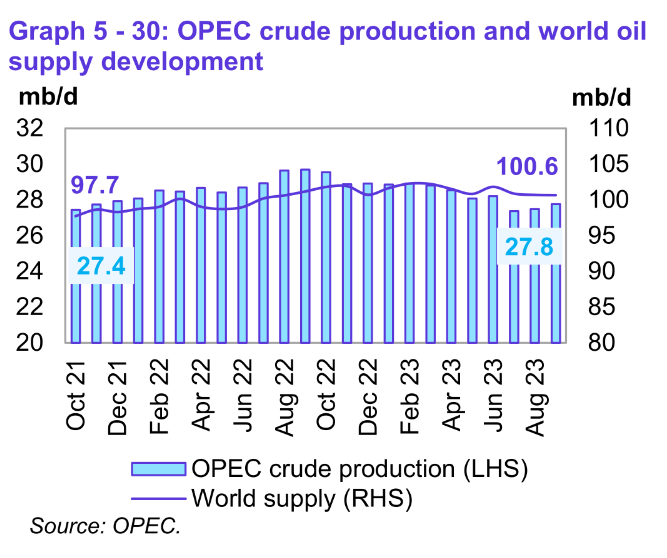

"Preliminary data indicates that global liquids production in September was 0.1 Mb/d less than last month and averaged 100.6 Mb/d."

My comment: So global oil production fell by 100 000 barrels in one month, in August-September 2023. If this decline pace continues, it means 1,2 million barrels per day lost in one year, which is a decline rate of 1,2 % per year. Expect this decline rate to continue, and at last to begin to accelerate in the coming years, as the bell curve does in the "

Hubbert curve":

We probably reached the post-pandemic "All Liquids" oil peak in February 2023, at 101,5 mbd (1). See the following graph from Coyne's blogpost above:

(Probably the

Dow Jones Index reached its all-time peak in December 2021, thirteen months before the post-pandemic peak of global oil production. These two, the stock market and the global oil production, go hand in hand)

Because of a long time of underinvestment in global oil production (see

this recent article) (this has been a recurrent theme among oil experts for a very long time, at least since 2014-2015 [2], see for example

this article from 2021), we can be sure that the peak of global oil production has been passed already, and that the trends we see today will continue down the pipeline, yes even accelerate, pick up pace, as time goes by.

The current decline in global net oil exports

If we take a very conservative, linear approach, and project a global oil production decline of 1,2% upon the future, ten, fifteen years from now, then the decline of global net oil exports is at least the double of that (3), i.e. a 2,4 % yearly decline, which is 2,4 mbd lost per year (if we fix the amount of decline, because in percentage declines the amount of decline slows down with time, which it doesn't do in our case), which gives us almost 13 years if we begin with 30 mbd of global net oil exports (which is a very conservative estimate. Oil geologist Jeffrey J. Brown said we were at 30 in the end of 2021, but there has been a sharp recovery in oil production since, therefore I think we are still at 30 mbd), which brings us to the year 2036.This year must be the absolute upper limit in our calculations.

If we then go to the decline of "ANE" ("Available Net Exports"), which is "GNE" ("Global Net Exports", the totality of global net oil exports) less the Chindia (China and India) region’s combined net oil imports, then the decline goes a lot faster, by at least 3 % per year, conservatively estimated. So 3 % of global oil production is ~3 mbd. We have 30 mbd of global net oil exports left, at most (we might in fact be already at 28, 27 or even 26 mbd, which takes us to the end point a bit sooner). This give us only 10 years of "ANE oil". And this brings us to the fall of 2033 (or to 2030-2032 if we are now at 26-28 mbd of global net oil exports, which we very well could be).

This, 2030-2033, is pretty much the best case scenario for the end of global net oil exports, and has been the result of professional licensed oil geologist Jeffrey J. Brown's net oil export calculations.

Observe that I have not taken into account that the real decline of both global oil production and global net oil exports is exponential (it's a mathematical certainty), i.e. have an accelerated rate of decline, goes faster and faster. With that in mind, the end of available global net oil exports (ANE) could very well happen well before 2030, which is the thesis in my book on the end of global net oil exports. I could certainly have been a bit too radical in my calculations in this book, but I think the core of it is solid and valid. It will be interesting to see how it all will play out, if there is any out there who tracks these things, which I think we should do.

But this, that we lose

at least 3 mbd of "ANE oil" this year, is staggering, unfathomable. And I would also like to add to my book, that

if I'm wrong in my predictions, I'm then not wrong by a lot of years, not by a decade, maybe only by one year or two, three at most, five to six years if miracles happen, which is not much in the grand scheme of things (as I said, 2030-2033 is the best case scenario)

. This should be clear to all who have studied my calculations. Do not

shoot the messenger too easily. "The wolf came at last" (read the story I allude to

here).

But I confess that when I read the many insignificant news at

www.oilprice.com, I have easily gotten the impression that all is well with oil, that we are always at the same levels of global net oil exports,

that there is no decline, not in exports, not in production, and even no Peak Oil. So badly they report on things. Just too much rubbish and meaningless stuff that

lulls people into a false sense of security, burying one's head in details.

(1)

"World oil supply leapt 830 kb/d in February to 101.5 mb/d as the US and Canada rebounded strongly from winter storms and other outages." (From the website

"Oil Market Report - March 2023). If we were at 100,6 in September this year, it's a decline of 0,9 mbd in 7 months, which translates to an average decline pace of ~1,54 mbd in a year, i.e. 1,54 %. This makes my calculations in this blogpost very conservative, because I calculate with a 1,2 % yearly decline, plus the fact that it is a linear decline, and that the decline amount is fixed. If we use the 1,54 % yearly decline, with a fixed amount of decline every year (otherwise the amount of decline would slightly decrease with time), then the decline of global net oil exports ("GNE") is at at least 3,08 mbd per year in a linear scenario, and the decline of "ANE" (Available Net Exports, which is "GNE" less the China and India region’s combined net oil imports) is at least 3,5-3,8 mbd per year in a linear scenario. How many years of "ANE oil" does this give us? Answer:

only 8,5 years if we begin with 30 mbd of global net oil exports, and 3,5 mbd of "ANE oil" lost every year, linearly. 8,5 years into the future brings us to the spring of 2031. If we begin with 27 mbd of global net oil exports, and with 3,8 mbd of "ANE oil" lost every year, linearly,

we get only 7,1 years, which brings us to the end of 2030.

Observe that this is a linear approach, and that in reality the decline is exponential, i.e. an accelerated rate of decline (this is a thought experiment). If we begin with

26 mbd of global net oil exports (GNE) (we could be at this amount right now, because GNE was at 30 mbd in the fall of 2021 according to Jeffrey J. Brown's calculations [4]), and with 3,8 mbd of "ANE oil" lost every year, linearly, we get

only 6,8 years, which brings us to the summer of 2029. Add then the exponential factor, and we are easily at 2027 as the end of "ANE oil", which confirms the calculations in

my book on the end of global net oil exports.

[2]

"There are three ways we can look at the depths of the underinvestment we have witnessed since 2015. Firstly, we can look at the reserve life in the sector. It used to be 50 years and it’s now declined to 25 on the back of falling oil reserves and increasing production. This shows the lack of focus in exploration and resource expansion on the back of the push for decarbonization.

The second way to look at it is to ask ourselves: How much future production have we lost because of all the delays in investment decisions on new oil and gas projects? The answer is 10 million barrels per day of oil, which is the equivalent of Saudi Arabia’s daily production and 3 million barrels per day of oil equivalent in liquefied natural gas (LNG), which is more than the equivalent of Qatar’s daily production. If we had not kept delaying new investment decisions in oil and gas since 2014, we essentially could have had a new Saudi Arabia and a new Qatar." (From this article on Goldman Sachs on April 28, 2022)

My comment: Those 10+3 million barrels per day (mbd) of oil/oil equivalents mentioned by the article above, this amount the global economy really had needed, if it were not for a cycle of oil supply scarcity/shocks/shortages and oil demand destruction that has plagued the global economy since at least the Great Financial Crisis in 2007-2008. If we had access to those 10+3 mbd today, the global economy would not be in this state of slowdown, or even partly, slow collapse, where it is today. This clearly shows the lack of investment in oil during the last decade, and how poor and wretched we have become, indeed (certainly the will to invest has been present, there is so much money to be made here, but we haven't got the gigantic sums of money and resources we need, because of more and more expensive oil projects, which stems from more and more unconventional oil exploration and oil discovery. We cannot, for example, afford Arctic oil, neither shale oil and tar sands in more and more difficult areas, of poorer and poorer quality.

Yes, a new Saudi Arabia in oil would have been needed during the last decade to stay afloat, and a new such is needed in the next decade, at least, to prevent further decline and an accelerated further collapse. We probably won't manage that, but we will have to run faster and faster to stay were we are (the "Red Queen syndrome"), right now, stay in a 1,2% yearly decline.

(3) In this article on "The Energy Bulletin" from 18 October 2010, Jeffrey J. Brown and Dr. Samuel Foucher calculated the decline rate of oil production in the North Sea between 1999 to 2009 to be at 4.8%/year. During the same time oil exports from the area fell by more than double the percentage, yes almost a triple. Brown and Foucher says:

"Note that the net export decline rate exceeded the production decline rate, starting out in double digits, at 12.8%/year, and accelerated to close to 30%/year at the end of the net export decline period."

So my estimate that the decline rate of oil exports is at least 2,4 % right now, is conservative and minimalist, at solid ground, I think. This confirms pretty much my calculations in my book, which might, though, have been too radical.

[4] See the article "The Road To Clean Energy Is Messier Than We Thought", by Loren Steffy, UH Energy Scholar, 14.10.2021 on Forbes.

![5 Hubbert's bell-shaped curve for time versus production of any exhaustible resources projection plot for the time interval 1850-2200 AC [7].](https://www.researchgate.net/profile/Neelu-Chouhan/publication/281206525/figure/fig3/AS:669141988020257@1536547290828/Hubberts-bell-shaped-curve-for-time-versus-production-of-any-exhaustible-resources.png)