(This blogpost is written primarily for Peak Oil pundits, and is a continuation and an update of the following blogposts on my former blog Forest Man, and on this blog:

The shale oil revolution is soon over

There has in the last half year been written a lot about how we are at the end of, or at the very last chapters of the shale oil revolution, the "Shale Boom" or "Fracking Boom" that began somewhere around 2010 in earnest, as a response to the end of cheap oil, when conventional oil output peaked. I have reported about many such articles in the blogposts above, but here are some additional and newer articles:

From this last article: "These days, various oil field experts are saying the U.S. Shale Revolution is over."

My comment: It is true, and it has been so for a long time. But the shale oil locomotive just seems to puff forward with great speed. Already in 2013 even IEA, wellknown for its optimism in energy predictions, predicted that Shale Oil would peak in 2020. See the article "IEA: Shale Boom is Only Temporary, we’ll Soon be Relying on Middle East Again", by Joao Peixe, on

November 12, 2013, on www.oilprice.com.

A global oil supply crunch in 2024?

"So has the recent setback dented Goldman's optimism? Not at all: in fact, according to Goldman chief commodity strategist, not only will oil rise back above $100 a barrel this year, it will rise much more in 2024 when it will face a serious supply problem as spare production capacity runs out."

“Right now, we’re still balanced to a surplus because China has still yet to fully rebound,” Currie said. Capacity is likely to become a problem later this year when demand outstrips supply, he said. “Are we going to run out of spare production capacity? Potentially by 2024 you start to have a serious problem.”

It is also time to remind you of the failed predictions of some cornucopian economists. Read this article:

Did the shale oil revolution go global? No. Many tried, countries like Colombia (see

this article), but failed. And what about the oil price? It has for a long time been four times the price that was usual before Peak Conventional Oil 2005, the cheap price that pertained for a long time before we ran out of cheap oil. Oil is expensive now, and will always be in the future, and high inflation and the destruction of purchasing power has made matters even worse.

A decline from the peak plateau of "All Liquids" in 2025 at the latest?

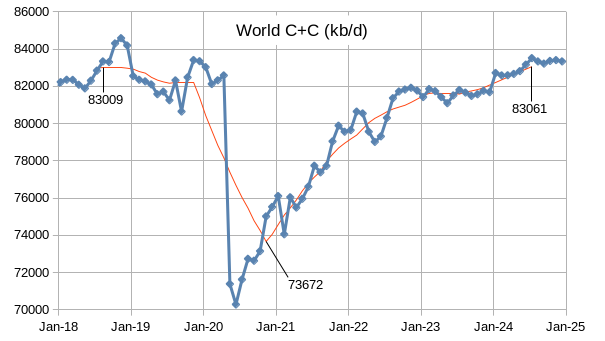

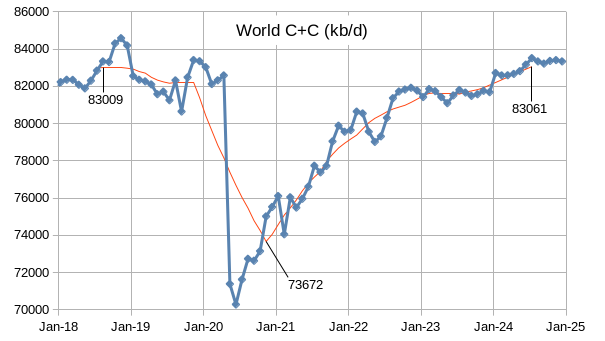

Because of all the information above, it seems reasonable to expect a beginning decline from the peak plateau that "All Liquids" (everything that is counted as "oil") is on right now (102-103 million barrels of oil per day), in 2024 or in 2025 at the latest. And it is also reasonable to expect an abrupt decline when the decline begins, so big is the energy bubble (1). Also Steve St. Angelo has expressed similar thoughts.

It can be good to remind you again of this recent forecast by Dennis Coyne on the

Peak Oil Barrel blog, from

this blogpost:

Where are we headed regarding the "All Liquids" production (the graph above is not "All Liquids", it's just Crude + Condensate?) Will the decline of "All Liquids" and Crude + Condensate begin in the beginning of 2025?

"The chart below is a little busy, so we will spend some time decoding it. The multi-colored, vertical bars show changes in the drawdown of Drilled, but Uncompleted (DUC) wells over the last four years. Low oil prices from 2019 through December, of 2021 drove a decline in DUCs from ~4,000 to 1,446, more than 75%. During this period, oil companies desperate for revenue and needing to control costs thanks to oil prices below $70 per barrel, turned to DUCs to maintain output. Post-January 2022, higher oil and gas prices drove a rapid increase in drilling, and attenuated the trend toward DUC activation as the year wore on. From January of 2023, both DUC withdrawals and drilling have declined and shale output has essentially flatlined around 9,300 mm BOPD, according to the monthly EIA-Drilling Productivity Report. The most recent results of which are captured in the graph below, along with rig data from Baker Hughes and frac spread count data from Primary Vision."

My comment: Mark the words: "From January of 2023, both DUC withdrawals and drilling have declined and shale output has essentially flatlined around 9,300 mm BOPD,"

Can this be true? Has the Shale Oil peaked? We will know after some time.

More from the article by Messler above:

"Daily shale output is nearing an inflection point and may soon start a rapid decline, that will be impossible to reverse, absent a huge increase in the rate of drilling new wells that cannot be sustained in today’s market."

My comment: Will Shale Oil and its finances survive the banking crisis, which only gets worse? This will be interesting to follow. What we know is that upstream investment has underperformed for a long time in the Oil Industry at large, and at last this industry must reap what it has sown.