Oil prices are rising fast. The decline of oil has begun.

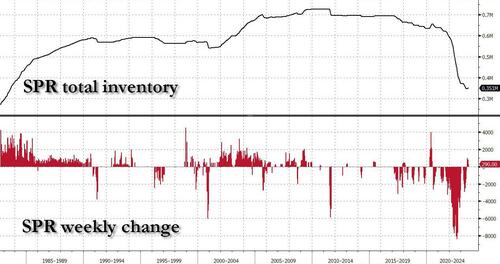

"After languishing a multi-year lows until the end of June in the low/mid-70s range after Biden drained over 270 million barrels from the SPR to a near record low in hopes of pushing the price of gasoline lower and achieving short-term political goals...

... oil has since surged by more than $20, or 32% since the low of $71.57 on June 28, its fastest ascent since the start of 2022, a rally that was sparked by Saudi Arabia's decision to voluntarily cut an additional 1 million bpd of production in addition to the reductions agreed by the OPEC+ group...

... thereby intentionally creating a production deficit of over 3 million barrels per day."

End quote.

Recently, today, Brent Crude was almost at 96 dollar. You can see for yourself on www.oilprice.com, in the statistics there.

It is incredible that the decline of oil already goes so fast. I cannot almost believe it.

It is good for Mother Earth.

Usually when oil supply is tight, when there is too little oil, it is more expensive. This has been the trend since 2005. Remember that before 2005 oil had for several decades been in the 20-25 dollar range.

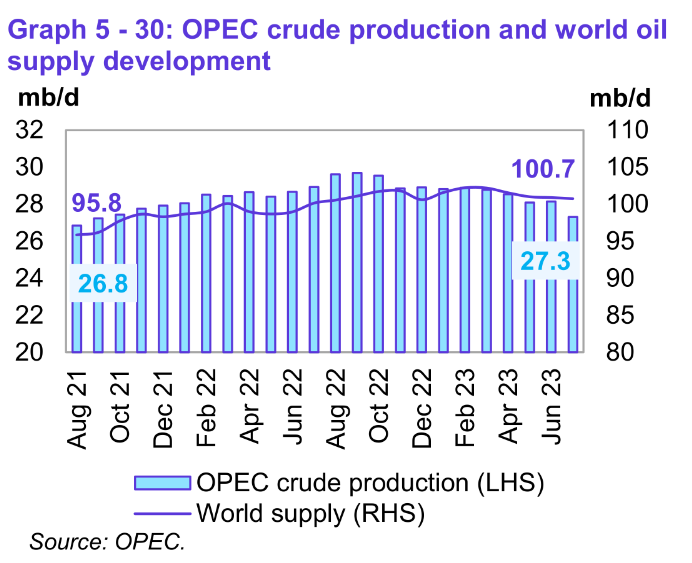

I want to remind you once again about the former production cuts that OPEC made during a timespan from about a year ago up until half a year ago:

"LONDON, April 3 (Reuters) - OPEC and its allies, including Russia, agreed on Sunday to widen crude oil production cuts to 3.66 million barrels per day (bpd) or 3.7% of global demand." (from this article by Reuters, a mainstream news outlet, 3.4.2023)

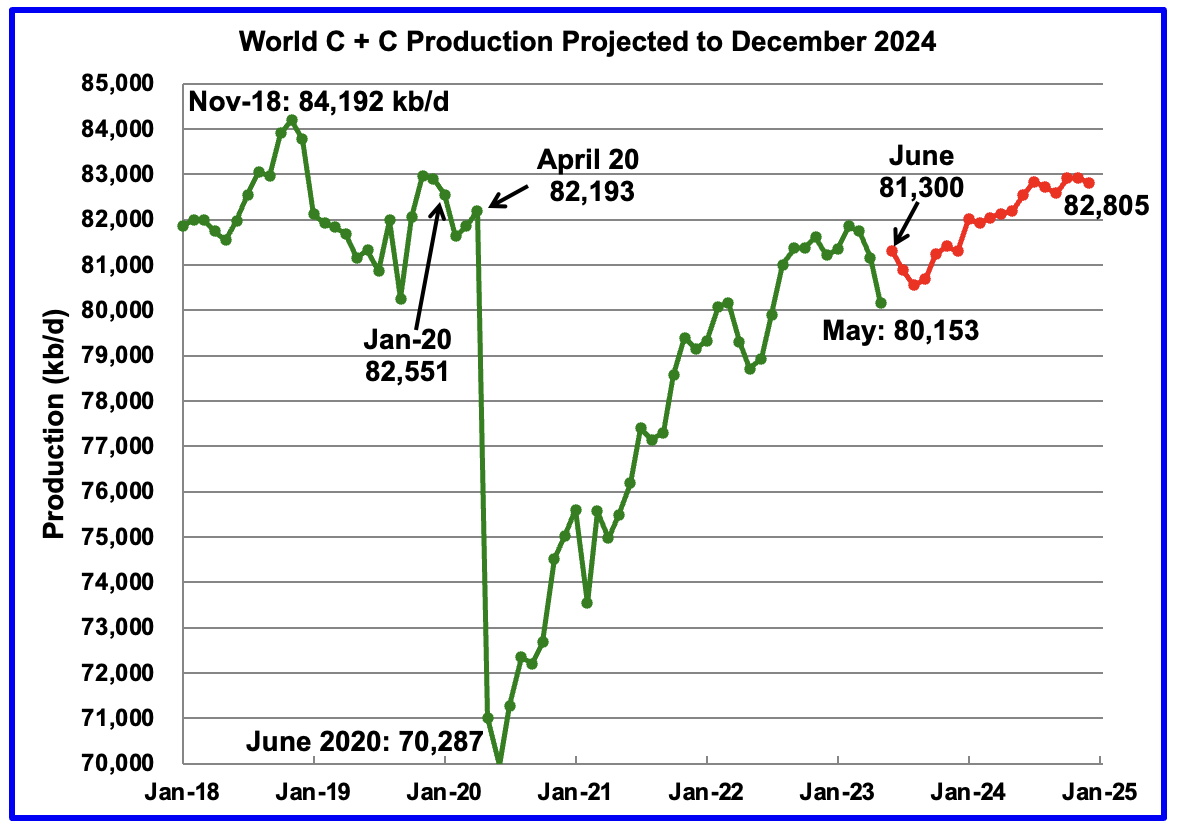

So the 3 mbd deficit that Tyler Durden just wrote about, is not about the difference between global oil supply and global oil demand, but about real cuts in oil production, and these are in the end about declining oil production, because we are past Peak Oil (it happened in November 2018, see the chart below), and global oil production (at least the conventional part of it) is declining. See the following chart from this blogpost on the blog Peak Oil Barrel (the chart has data up to May 2023, but we know that the decline has continued since then, US shale oil has not been able to make up for the decline in the rest of the oil industry. Note the 2 mbd of decline since the beginning of 2023):

See also the following chart from this blogpost on the blog Peak Oil Barrel (where the most detailed and most initiated information on pretty much the whole internet, is to be found about Peak Oil*):

(Note the big decline in OPEC oil production in October 2022, April 2023 and June 2023, which are when OPEC made cuts in its oil production. It seems that my initial doubts about OPEC really making those cuts, were wrong)

Thinking about our collapsing world economy (read this recent article by energy expert and collapsologist professor Michael T. Klare) isn't it pretty clear that the final and ultimate and irreversible decline of oil has begun? Already in 2020, on March 22 2022, Rex Weyler from Greenpeace wrote the fateful article "The decline of oil has already begun". How right those warnings were, after all.

How exciting it is to be alive in these times. We are really in uncharted territory.

How shall we make up for those 3 million barrels of oil that we lack now? The cuts are not only political, they are not only about an oil price war between OPEC and the US, it's a question of inevitable decline of oil, this is exceedingly clear for those who have followed Peak Oil blogs for an extended period of time. The numerous warnings are pretty old by now.

A 3 mbd deficit. In one year. It is a decline of about 3 % in only one year. You certainly will hear more and more such news in the future, because the decline of oil accelerates. Soon the yearly decline will be 5 % and more, and then the decline of oil exports will go really, really fast, because oil exports has declined already in an environment of rising global oil production.

All this was expected in my book "The end of global net oil exports. What really matters in the Peak Oil debate" (2023).

Update 17.7.2024: These data that I provided, are the official, corporate and government data, but mind that Chris Martenson has said that he is not sure he can believe in them. So distorted the numbers have been on all fronts in the economy, not least in the US. Think always about this when you look at graphs about oil and energy at large.

* If you have followed the comments section on the Peak Oil Barrel blog, you have certainly noticed an ongoing debate between pessimists and optimists in the Peak Oil debate, where Ron Patterson, the owner of the blog, is the leading pessimist, who thinks oil peaked in november 2018, and will never surpass that peak, and where Dennis Coyne, one of the contributors to the blog, is the leading optimist, who thinks oil will reach a new peak later this decade, maybe in the middle of the decade. It will be really interesting to see who of these two parties will win the debate. After a couple of years we'll know the result. But some said that we know that we have reached Peak Oil only five years after, and soon five years have passed since November 2018. But the abrupt decline in oil because of the pandemic, has complicated the issue.